Navigating the Fluctuations: Understanding 916 Gold Prices in 2023

Related Articles: Navigating the Fluctuations: Understanding 916 Gold Prices in 2023

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Fluctuations: Understanding 916 Gold Prices in 2023. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fluctuations: Understanding 916 Gold Prices in 2023

Gold, a precious metal coveted for its beauty and value, has consistently been a popular investment and a symbol of wealth for centuries. In the Indian market, 916 hallmark gold, also known as 22 karat gold, holds significant importance due to its purity and widespread acceptance. However, understanding the dynamics of 916 gold prices is crucial for making informed decisions, whether for buying jewelry, investing, or selling existing gold assets.

This article aims to provide a comprehensive overview of the factors influencing 916 gold prices in 2023, demystifying the intricate interplay of global markets, domestic policies, and consumer demand. We will delve into the historical trends, current market conditions, and potential future projections, equipping readers with the knowledge to navigate this dynamic landscape.

Understanding the Basics: 916 Gold and its Hallmark

916 gold signifies a purity level of 91.6% pure gold, with the remaining percentage comprising other metals like silver, copper, and zinc. This alloying process enhances the durability and workability of gold, making it suitable for crafting jewelry and other intricate designs. The "916" hallmark, mandated by the Bureau of Indian Standards (BIS), ensures the authenticity and purity of the gold, providing consumers with confidence in their purchases.

Factors Influencing 916 Gold Prices

The price of 916 gold is not static; it fluctuates constantly, influenced by a complex interplay of factors:

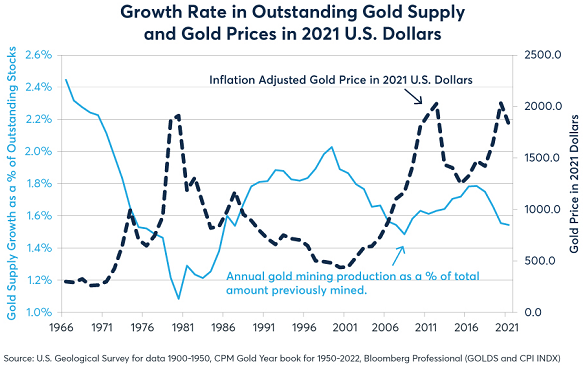

- Global Gold Market: The international gold market, primarily driven by the London Bullion Market Association (LBMA), sets the benchmark for global gold prices. Changes in supply and demand dynamics in this market directly impact domestic gold prices.

- US Dollar Strength: The US dollar, being the dominant currency in global trade, plays a significant role in gold pricing. A strengthening dollar generally leads to a decline in gold prices, as investors find it more attractive to hold dollar-denominated assets. Conversely, a weakening dollar can push gold prices higher.

- Interest Rates: Central bank interest rate policies impact gold prices indirectly. When interest rates rise, investors tend to shift towards assets like bonds that offer higher returns, leading to a decrease in demand for gold. Lower interest rates often encourage gold purchases.

- Inflation and Economic Uncertainty: During periods of high inflation or economic instability, gold is often perceived as a safe-haven asset. Investors seek refuge in gold as a hedge against inflation and economic uncertainty, driving up its price.

- Geopolitical Events: Major geopolitical events, such as wars, political tensions, or global trade disputes, can create market volatility and impact gold prices. In times of uncertainty, investors often turn to gold as a safe haven, increasing its demand.

- Jewelry Demand: India, with its vibrant jewelry culture, is a significant consumer of gold. Seasonal festivals and auspicious occasions often see a surge in demand for gold jewelry, impacting domestic prices.

- Government Policies: Government policies, such as import duties and taxes, can influence gold prices. Changes in these policies can impact the cost of importing gold, leading to fluctuations in domestic prices.

Analyzing Historical Trends and Current Market Conditions

Over the past few years, 916 gold prices have experienced significant fluctuations, reflecting the interplay of the factors mentioned above.

- 2020-2021: The COVID-19 pandemic initially triggered a surge in gold prices as investors sought safe haven assets. However, as global economies began to recover, gold prices stabilized and eventually declined.

- 2022: The Russia-Ukraine conflict, coupled with rising inflation and interest rate hikes, contributed to increased gold prices.

- 2023: The current year has seen continued volatility in gold prices, influenced by factors like ongoing geopolitical tensions, economic uncertainties, and fluctuating interest rates.

Predicting Future Trends: A Look Ahead

Predicting future gold prices is a complex endeavor, subject to numerous variables and market dynamics. However, some key factors can provide insights into potential trends:

- Global Economic Outlook: The overall economic health of major economies, particularly the US and China, will influence gold prices. Strong economic growth may lead to a decline in gold demand, while economic slowdowns or recessions could boost its appeal as a safe haven.

- Inflationary Pressures: Persistent inflation could continue to drive gold prices higher, as investors seek protection against eroding purchasing power.

- Interest Rate Policies: Central banks’ interest rate policies will continue to impact gold prices. Rising interest rates could dampen gold demand, while lower rates might encourage gold purchases.

- Geopolitical Risks: Ongoing geopolitical tensions and potential conflicts could contribute to gold price volatility. Investors may seek refuge in gold during periods of uncertainty.

- Investment Demand: Gold’s appeal as an investment asset will play a crucial role in price trends. Factors like investor sentiment, market volatility, and alternative investment opportunities will influence gold demand.

FAQs on 916 Gold Prices

1. How can I track 916 gold prices in real-time?

Numerous online platforms and financial news websites provide real-time gold price updates. Reputable sources like the LBMA, the World Gold Council, and leading financial news outlets offer accurate and reliable data.

2. What are the factors that influence the price of 916 gold jewelry?

In addition to the factors mentioned above, the price of 916 gold jewelry is also influenced by:

- Making Charges: Jewelry makers charge a fee for their craftsmanship, which varies depending on the intricacy of the design and the weight of the gold used.

- Stone Settings: If the jewelry incorporates precious or semi-precious stones, their cost is added to the overall price.

- Retailer Markup: Retailers add a markup to the cost of gold and manufacturing to cover their operational expenses and profit margin.

3. How can I buy 916 gold jewelry at the best price?

To ensure you get the best price for 916 gold jewelry, consider the following tips:

- Compare Prices: Shop around at multiple retailers to compare prices and making charges.

- Check for Discounts: Look for seasonal sales, promotional offers, or discounts on specific designs.

- Negotiate: Don’t hesitate to negotiate with the retailer, especially for larger purchases.

- Consider Buying During Off-Peak Seasons: Gold prices tend to be lower during off-peak seasons, such as the months following major festivals.

4. What are the risks associated with investing in gold?

While gold can be a valuable investment, it’s important to understand the associated risks:

- Price Volatility: Gold prices can fluctuate significantly, and investors could experience losses if prices decline.

- No Dividends or Interest: Gold does not generate dividends or interest payments, unlike other investments like stocks or bonds.

- Storage Costs: Storing gold can involve costs, such as safe deposit box rentals or insurance premiums.

5. Is it advisable to invest in 916 gold jewelry?

Investing in gold jewelry can be a good option for those seeking both a tangible asset and an element of personal style. However, it’s essential to consider the following:

- Liquidity: Selling gold jewelry can be time-consuming and may involve a discount compared to buying it.

- Making Charges: Jewelry making charges can significantly impact the investment value, reducing the potential return on investment.

- Risk Tolerance: Investors should consider their risk tolerance and investment goals before investing in gold jewelry.

Tips for Buying 916 Gold Jewelry

- Verify Hallmark: Always ensure the jewelry you purchase carries the BIS hallmark, signifying its authenticity and purity.

- Check for Purity: Ask the retailer for a certificate of authenticity confirming the purity of the gold.

- Understand Making Charges: Clarify the making charges before making a purchase.

- Compare Designs and Prices: Explore different designs and compare prices from multiple retailers.

- Consider Insurance: Insure your gold jewelry to protect it against loss, theft, or damage.

Conclusion

Understanding the factors influencing 916 gold prices is crucial for making informed decisions, whether for buying jewelry, investing, or selling existing gold assets. The global gold market, domestic policies, and consumer demand are key drivers of price fluctuations. While predicting future trends is challenging, keeping abreast of market dynamics, considering investment goals, and utilizing the tips outlined above can help individuals navigate the world of 916 gold with confidence.

:max_bytes(150000):strip_icc()/Goldchart-997cf958e5b941a79e319b82a078283f.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fluctuations: Understanding 916 Gold Prices in 2023. We hope you find this article informative and beneficial. See you in our next article!