Navigating the Golden Path: A Guide to Importing Gold into the United States

Related Articles: Navigating the Golden Path: A Guide to Importing Gold into the United States

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Golden Path: A Guide to Importing Gold into the United States. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Golden Path: A Guide to Importing Gold into the United States

The allure of gold has captivated humanity for centuries. Its intrinsic value, historical significance, and potential for investment continue to make it a sought-after commodity. For those seeking to bring gold into the United States, understanding the specific regulations and procedures is paramount. This comprehensive guide aims to demystify the process, providing clarity on the necessary requirements and steps involved.

Understanding the Regulations: A Framework for Importing Gold

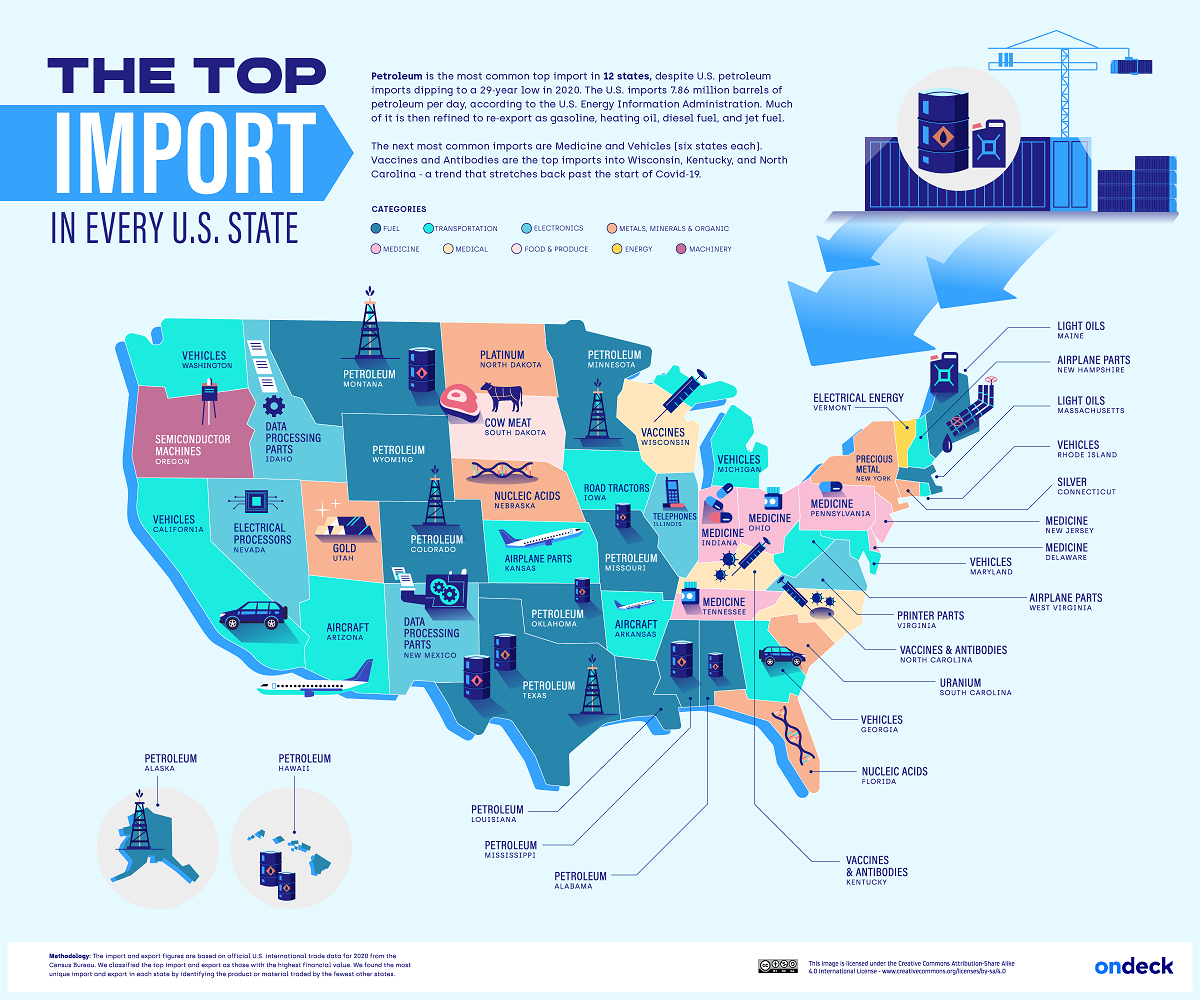

Importing gold into the United States is governed by a complex web of regulations, overseen by various government agencies. The primary agencies involved are:

- U.S. Customs and Border Protection (CBP): Responsible for enforcing import regulations, collecting duties and taxes, and preventing the entry of prohibited goods.

- U.S. Department of the Treasury: Oversees the financial system, including currency and precious metals, and sets policies regarding import and export of gold.

- U.S. Department of Commerce: Monitors trade and economic activity, including the import and export of goods, and may impose restrictions on certain types of gold imports.

The Importance of Declaration and Documentation:

The first step in importing gold into the United States is to accurately declare the shipment to CBP. This declaration must include detailed information about the gold, such as:

- Quantity: The weight and purity of the gold.

- Form: Whether it is in bullion, coins, jewelry, or other forms.

- Origin: The country where the gold was sourced.

- Value: The declared value of the gold for customs purposes.

Required Documentation:

To facilitate the smooth import process, the following documentation is typically required:

- Commercial Invoice: A detailed document outlining the transaction, including the seller, buyer, and detailed description of the goods.

- Packing List: A document that lists the contents of the shipment and their packaging details.

- Bill of Lading: A document that serves as a contract between the shipper and the carrier, confirming the shipment details and terms of transportation.

- Certificate of Origin: A document that certifies the country of origin of the gold.

- Import Permit (if applicable): Depending on the type and origin of the gold, specific permits may be required.

Customs Duties and Taxes:

Upon arrival at a U.S. port of entry, the imported gold will be subject to customs duties and taxes. The specific rate of duty will depend on the origin of the gold and its form.

- Duty: The duty rate for gold is typically 0%, but may vary depending on the origin and form of the gold.

- Taxes: In addition to duty, the gold may be subject to state and local taxes, depending on the jurisdiction.

Compliance with Regulations:

Strict adherence to the regulations is crucial. Failure to comply may result in fines, penalties, and even seizure of the gold. It is advisable to consult with a customs broker or an attorney specializing in international trade law to ensure compliance with all applicable regulations.

Specific Considerations for Different Forms of Gold:

The requirements for importing different forms of gold can vary. Here’s a breakdown:

- Gold Bullion: Bullion, in the form of bars or ingots, is typically imported for investment purposes. It is generally subject to the standard import procedures outlined above.

- Gold Coins: Coins, both numismatic and bullion, require special attention. Numismatic coins, with historical or collectible value, may be subject to additional scrutiny and documentation requirements.

- Gold Jewelry: Jewelry made of gold is often subject to import duty and taxes. The specific rate will depend on the type and origin of the jewelry.

Benefits of Importing Gold into the United States:

Importing gold into the United States can offer various benefits, including:

- Investment Opportunity: Gold is considered a safe-haven asset, offering potential for capital appreciation and portfolio diversification.

- Preservation of Wealth: Gold has historically proven to be a hedge against inflation and economic uncertainty.

- Liquidity: Gold can be easily bought and sold in the global market, providing liquidity for investment needs.

FAQs Regarding Gold Importation:

1. Do I need a license to import gold into the United States?

Generally, a specific license is not required to import gold into the United States. However, depending on the origin and form of the gold, certain permits or authorizations may be necessary.

2. What are the penalties for importing gold illegally?

Importing gold without complying with the regulations can result in significant penalties, including:

- Fines: Penalties can range from a few hundred dollars to tens of thousands of dollars, depending on the severity of the violation.

- Seizure of the gold: The gold may be seized by CBP and forfeited to the government.

- Criminal prosecution: In cases of serious violations, individuals may face criminal charges and imprisonment.

3. How can I determine the value of my gold for customs purposes?

The value of the gold for customs purposes is typically determined based on the market price at the time of importation. It is advisable to consult with a qualified appraiser or a customs broker to obtain an accurate valuation.

4. Can I import gold as a personal item?

Importing small amounts of gold as personal items, such as jewelry, is generally permitted. However, it is important to declare the gold to CBP and ensure compliance with all relevant regulations.

5. How long does it take to import gold into the United States?

The time required for importing gold can vary depending on the shipment size, the origin of the gold, and the efficiency of the customs process. It is advisable to allow sufficient time for the import process.

Tips for Importing Gold into the United States:

- Plan Ahead: Thoroughly research the regulations and requirements before importing gold.

- Choose a Reputable Broker: Engage a customs broker with experience in handling gold imports to ensure compliance and smooth processing.

- Accurate Documentation: Ensure all required documentation is accurate and complete.

- Transparency: Be transparent with CBP and provide all necessary information.

- Compliance: Strictly adhere to all applicable regulations and procedures.

Conclusion:

Importing gold into the United States requires careful planning, meticulous documentation, and strict adherence to regulations. Understanding the process, seeking professional guidance, and maintaining transparency with authorities are crucial for a successful import. By navigating the golden path with knowledge and diligence, individuals can unlock the potential benefits of this precious commodity.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Golden Path: A Guide to Importing Gold into the United States. We hope you find this article informative and beneficial. See you in our next article!