silver prices coins vs gold

Related Articles: silver prices coins vs gold

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to silver prices coins vs gold. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: silver prices coins vs gold

- 2 Introduction

- 3 The Silver vs. Gold Price Dance: A Comprehensive Analysis

- 3.1 Understanding the Fundamentals: Silver and Gold

- 3.2 The Silver-Gold Ratio: A Key Metric

- 3.3 Historical Trends: A Glimpse into the Past

- 3.4 The Present Scenario: A Look at Current Market Dynamics

- 3.5 Silver vs. Gold: Investment Considerations

- 3.6 FAQs on Silver vs. Gold Prices

- 3.7 Tips for Investing in Silver and Gold

- 3.8 Conclusion: A Dynamic Relationship with Lasting Value

- 4 Closure

The Silver vs. Gold Price Dance: A Comprehensive Analysis

The relationship between silver and gold prices is a fascinating dynamic within the precious metals market. While both are considered safe haven assets, their price movements often diverge, offering unique investment opportunities and challenges. This article delves into the intricacies of this dynamic, exploring factors influencing their price fluctuations, historical trends, and potential implications for investors.

Understanding the Fundamentals: Silver and Gold

Silver and gold are both precious metals with inherent value, prized for their beauty, durability, and versatility. Both have been used as currency, a store of value, and in industrial applications for centuries. However, their supply, demand, and perceived value fluctuate based on various factors, leading to price discrepancies.

Gold:

- Supply: Gold is a relatively scarce metal with limited new discoveries. Production comes from both mining and recycling.

- Demand: Gold is primarily driven by investment demand, with central banks, jewelry manufacturers, and individual investors contributing to its market.

- Industrial Applications: While gold’s industrial uses are limited, it plays a role in electronics, dentistry, and aerospace.

Silver:

- Supply: Silver is more abundant than gold, with significant production from mining and as a byproduct of other metal extraction.

- Demand: Silver’s demand is more diverse, including industrial applications, jewelry, and investment.

- Industrial Applications: Silver is crucial in solar panels, electronics, and photography.

The Silver-Gold Ratio: A Key Metric

The silver-gold ratio represents the number of ounces of silver required to purchase one ounce of gold. This ratio fluctuates constantly, reflecting the relative price movements of both metals. Historically, the ratio has ranged from 10:1 to 100:1, indicating periods of significant price divergence.

Factors Influencing the Ratio:

- Supply and Demand Dynamics: Changes in the supply and demand of either metal can significantly impact the ratio. For example, a surge in industrial demand for silver could drive its price up, leading to a lower silver-gold ratio.

- Economic Conditions: During economic uncertainty, investors often seek safe haven assets like gold, driving up its price relative to silver.

- Investment Sentiment: Investor perception and market sentiment play a crucial role in influencing the ratio. If investors perceive silver as a better investment opportunity, its price may rise, leading to a lower silver-gold ratio.

- Speculation and Market Manipulation: Speculative trading and market manipulation can also influence the ratio, creating short-term price fluctuations.

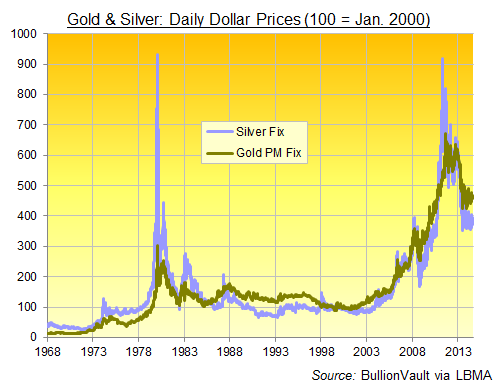

Historical Trends: A Glimpse into the Past

Analyzing historical price movements of silver and gold provides valuable insights into their relationship.

Historical Highlights:

- The 20th Century: The silver-gold ratio experienced significant fluctuations throughout the 20th century, driven by factors like the silver market manipulation in the 1970s and the gold standard’s abandonment.

- The 21st Century: The early 2000s saw the ratio fluctuate around 60:1, but it has since moved closer to 80:1, indicating a widening price gap between gold and silver.

The Present Scenario: A Look at Current Market Dynamics

The current market environment presents both opportunities and challenges for investors in silver and gold.

Key Factors Shaping the Market:

- Inflation: Rising inflation has driven investors towards precious metals as a hedge against currency devaluation, boosting demand for both gold and silver.

- Interest Rates: Increasing interest rates can make holding precious metals less attractive, potentially putting downward pressure on their prices.

- Geopolitical Uncertainty: Global tensions and geopolitical instability often lead to safe haven demand for gold, driving its price higher.

- Industrial Demand: The growing demand for silver in industries like solar energy and electronics could support its price.

Silver vs. Gold: Investment Considerations

Investing in precious metals requires careful consideration of individual risk tolerance, investment goals, and market conditions.

Factors to Consider When Choosing Between Silver and Gold:

- Volatility: Silver tends to be more volatile than gold, offering greater potential for returns but also carrying higher risk.

- Industrial Demand: Silver’s industrial applications make it more susceptible to economic cycles and technological advancements.

- Investment Horizon: Long-term investors may prefer gold for its historical stability, while short-term traders might favor silver’s potential for faster price movements.

- Liquidity: Gold is generally more liquid than silver, meaning it can be bought and sold more easily.

FAQs on Silver vs. Gold Prices

1. Is silver a better investment than gold?

There is no definitive answer to this question. The "better" investment depends on individual circumstances, risk tolerance, and investment goals.

2. What are the advantages of investing in silver?

- Higher potential returns: Silver has historically been more volatile than gold, offering greater potential for price appreciation.

- Industrial demand: Silver’s widespread industrial applications provide a strong foundation for its demand.

- Relative affordability: Silver is generally cheaper than gold, making it more accessible to investors with limited capital.

3. What are the advantages of investing in gold?

- Safe haven status: Gold is considered a safe haven asset, providing protection against economic uncertainty and inflation.

- Historical stability: Gold has a long history of holding its value, making it a reliable store of wealth.

- Liquidity: Gold is more liquid than silver, making it easier to buy and sell.

4. How can I invest in silver and gold?

- Physical bullion: Investing in physical silver and gold coins, bars, or rounds offers ownership of the underlying metal.

- Exchange-traded funds (ETFs): ETFs track the price of gold and silver, providing a convenient and diversified way to invest.

- Futures contracts: Futures contracts allow investors to speculate on the future price of silver and gold.

5. What are the risks associated with investing in silver and gold?

- Price volatility: Both silver and gold prices can fluctuate significantly, leading to potential losses.

- Storage costs: Storing physical bullion requires secure facilities and insurance.

- Market manipulation: Speculative trading and market manipulation can influence prices.

Tips for Investing in Silver and Gold

- Do your research: Understand the fundamentals of the precious metals market, including supply, demand, and historical trends.

- Set clear investment goals: Define your objectives for investing in silver and gold, whether it’s for diversification, inflation protection, or long-term wealth preservation.

- Diversify your portfolio: Don’t put all your eggs in one basket. Allocate your investments across different asset classes, including stocks, bonds, and real estate.

- Consider your risk tolerance: Be aware of the volatility associated with precious metals and invest only what you can afford to lose.

- Seek professional advice: Consult with a financial advisor to develop an investment strategy that aligns with your individual circumstances.

Conclusion: A Dynamic Relationship with Lasting Value

The relationship between silver and gold prices is a complex and dynamic one, influenced by a multitude of factors. Understanding the fundamentals of these metals, analyzing historical trends, and considering current market conditions is crucial for investors seeking to navigate this dynamic landscape. While both offer potential benefits, their inherent differences require careful consideration based on individual investment goals and risk tolerance. Ultimately, both silver and gold hold a unique place in the investment world, offering diversification, potential for growth, and a sense of security in uncertain times.

.png)

![Gold vs. Silver [The 5 Differences That Matter Most to Investors]](https://s3-us-west-2.amazonaws.com/gs-live/uploads/1566312499828-Gold+vs+Silver+2.png)

Closure

Thus, we hope this article has provided valuable insights into silver prices coins vs gold. We hope you find this article informative and beneficial. See you in our next article!