Understanding Share Transactions in Tally: A Comprehensive Guide

Related Articles: Understanding Share Transactions in Tally: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Share Transactions in Tally: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Share Transactions in Tally: A Comprehensive Guide

Tally, a widely used accounting software, plays a crucial role in managing and tracking financial transactions for businesses of all sizes. When it comes to managing shares, a critical aspect of many companies, Tally provides robust tools for accurate recording and reporting. This guide delves into the intricacies of handling share transactions within the Tally environment, focusing on the appropriate accounting heads and their significance.

The Importance of Accurate Share Management

Share transactions are fundamental to the operations of companies, particularly those with share capital. These transactions encompass various activities, including:

- Issuance of shares: The initial offering of shares to investors.

- Share buybacks: Repurchasing shares from existing shareholders.

- Dividend payments: Distributing profits to shareholders.

- Share transfers: Transferring ownership of shares between individuals or entities.

Accurate recording and management of these transactions are essential for several reasons:

- Compliance with regulations: Companies are obligated to adhere to legal and regulatory requirements governing share transactions.

- Financial transparency: Accurate records provide transparency into the company’s ownership structure and financial performance.

- Investor confidence: Transparent and accurate reporting builds trust and confidence among investors.

- Tax compliance: Correctly recording share transactions ensures accurate tax calculations and reporting.

Understanding Share Accounting Heads in Tally

Tally offers a comprehensive set of accounting heads specifically designed for managing share transactions. These heads are categorized under different groups, providing a structured approach to recording and reporting:

1. Share Capital:

- Equity Share Capital: This head represents the total value of equity shares issued by the company. It reflects the initial investment made by shareholders.

- Preference Share Capital: This head accounts for the capital raised through preference shares, which offer specific rights and privileges to holders.

- Calls in Arrears: This head tracks the unpaid amounts on shares issued by the company. It is essential for monitoring outstanding payments from shareholders.

- Share Forfeiture: This head records the forfeiture of shares when a shareholder fails to pay the required amount.

2. Share Premium:

- Share Premium: This head records the amount received from shareholders above the par value of the shares. It represents the premium paid for shares due to their market value exceeding the par value.

3. Share Application and Allotment:

- Share Application Money: This head tracks the initial payment received from shareholders when applying for shares.

- Share Allotment Money: This head records the amount received from shareholders upon the allotment of shares.

4. Share Buyback:

- Share Buyback: This head accounts for the repurchase of shares from existing shareholders. It is used to reduce the number of outstanding shares in the market.

5. Dividend:

- Dividend Payable: This head records the amount of dividends declared by the company but not yet paid to shareholders.

- Dividend Paid: This head tracks the dividends that have been paid to shareholders.

6. Other Share Transactions:

- Share Transfer Fees: This head accounts for the fees charged for transferring shares between individuals or entities.

- Share Issue Expenses: This head records the expenses incurred during the process of issuing new shares.

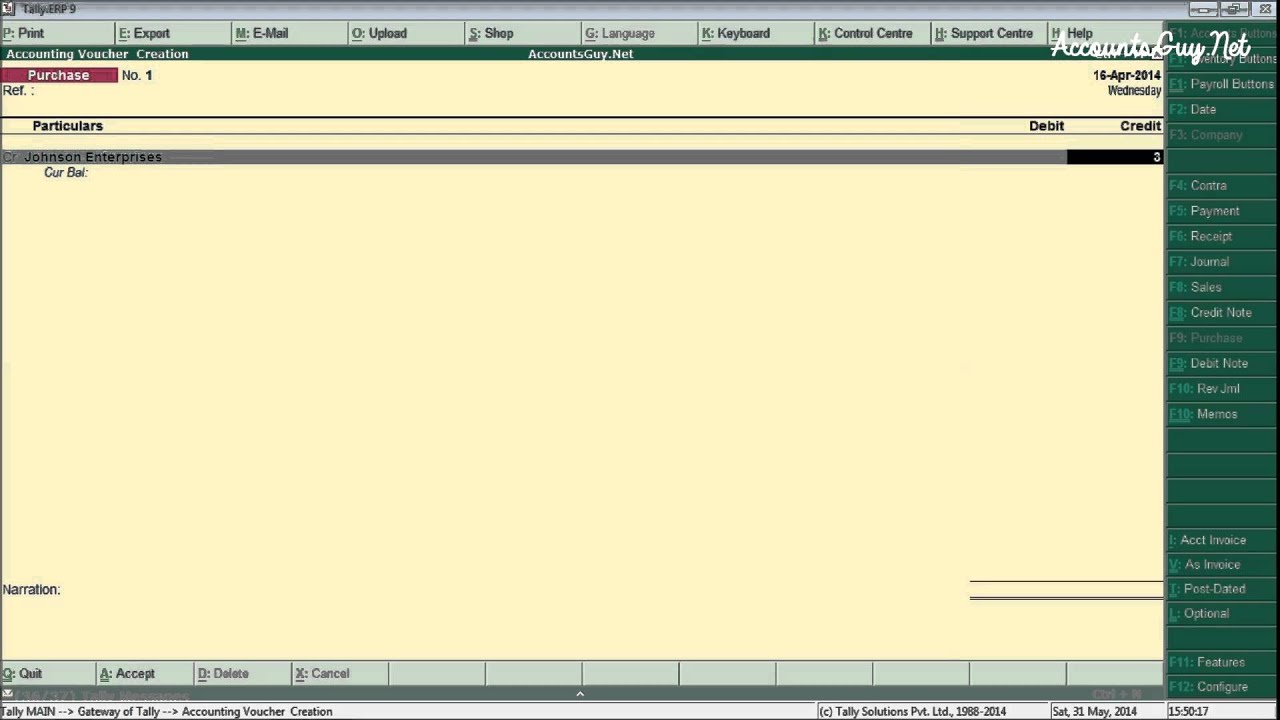

Practical Examples of Share Transactions in Tally

Let’s illustrate the use of these accounting heads with practical examples:

Example 1: Issuance of Equity Shares

- A company issues 10,000 equity shares at a par value of Rs. 10 per share, receiving a premium of Rs. 5 per share.

- In Tally, the transaction is recorded as follows:

- Debit: Bank Account (Rs. 150,000) – Representing the total amount received (10,000 shares * Rs. 15 per share).

- Credit: Equity Share Capital (Rs. 100,000) – Representing the par value of the shares (10,000 shares * Rs. 10 per share).

- Credit: Share Premium (Rs. 50,000) – Representing the premium received (10,000 shares * Rs. 5 per share).

Example 2: Share Buyback

- A company repurchases 2,000 of its own shares at a price of Rs. 18 per share.

- In Tally, the transaction is recorded as follows:

- Debit: Share Buyback (Rs. 36,000) – Representing the total amount paid for the shares (2,000 shares * Rs. 18 per share).

- Credit: Bank Account (Rs. 36,000) – Representing the payment made for the shares.

Example 3: Dividend Payment

- A company declares a dividend of Rs. 2 per share on its 10,000 equity shares.

- In Tally, the transaction is recorded as follows:

- Debit: Dividend Payable (Rs. 20,000) – Representing the total dividend payable (10,000 shares * Rs. 2 per share).

- Credit: Profit & Loss Account (Rs. 20,000) – Representing the deduction of the dividend amount from the company’s profits.

Benefits of Effective Share Management in Tally

Implementing robust share management practices in Tally offers numerous benefits:

- Enhanced financial reporting: Tally’s comprehensive accounting heads provide detailed insights into the company’s share capital structure and related transactions.

- Improved decision-making: Accurate and timely information on share transactions empowers management to make informed decisions regarding capital structure, dividend policies, and other strategic initiatives.

- Streamlined compliance: Tally’s features facilitate compliance with regulatory requirements related to share transactions, minimizing the risk of penalties or legal issues.

- Increased investor confidence: Transparent and accurate share management practices enhance investor confidence in the company’s financial health and governance.

FAQs on Share Transactions in Tally

1. How do I record a share transfer in Tally?

- Share transfers are typically recorded in the "Share Transfer" or "Share Transfer Fee" accounting head. The transaction involves debiting the recipient’s share capital account and crediting the transferor’s share capital account.

2. Can I track share splits and consolidations in Tally?

- Yes, Tally provides tools for recording share splits and consolidations. These transactions require adjustments to the share capital and related accounting heads.

3. How do I generate reports on share transactions in Tally?

- Tally offers various reports, including balance sheets, profit and loss statements, and share transaction summaries, which provide insights into the company’s share capital and related activities.

4. Can I integrate Tally with other financial systems for share management?

- Tally can be integrated with other systems, such as stock exchanges and brokerage platforms, to facilitate seamless share transactions and data synchronization.

5. How do I manage shareholder records in Tally?

- Tally allows you to create and maintain a comprehensive shareholder database, including details such as names, addresses, and shareholdings.

Tips for Effective Share Management in Tally

- Use descriptive accounting heads: Employ clear and descriptive accounting heads to ensure accurate and meaningful reporting.

- Maintain detailed records: Keep detailed records of all share transactions, including dates, amounts, and relevant parties.

- Regularly reconcile records: Reconcile share transactions with external records, such as share certificates and brokerage statements, to ensure accuracy.

- Stay updated on regulations: Keep abreast of changes in regulations governing share transactions to ensure compliance.

- Seek professional advice: Consult with accounting professionals to ensure you are using Tally effectively for share management.

Conclusion

Managing share transactions effectively is crucial for any company that issues shares. Tally provides a comprehensive framework for recording and reporting these transactions, offering valuable insights into the company’s capital structure and shareholder activity. By leveraging Tally’s features and following best practices, businesses can ensure accurate and transparent share management, fostering investor confidence and promoting financial stability.

Closure

Thus, we hope this article has provided valuable insights into Understanding Share Transactions in Tally: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!