Unraveling the Intricacies of Gold Investment Schemes: A Comprehensive Guide

Related Articles: Unraveling the Intricacies of Gold Investment Schemes: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unraveling the Intricacies of Gold Investment Schemes: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unraveling the Intricacies of Gold Investment Schemes: A Comprehensive Guide

The allure of gold as a safe haven asset has captivated investors for centuries. In the realm of investment, gold schemes offer a unique avenue for individuals to accumulate wealth through a systematic and structured approach. Among the diverse range of gold schemes available, the "Prince Jewellery Gold Scheme" has garnered considerable attention for its unique features and potential benefits. This article delves into the intricacies of this scheme, providing a comprehensive understanding of its workings, advantages, and considerations.

Understanding the Essence of Gold Investment Schemes

Gold investment schemes are structured programs designed to facilitate the accumulation of gold over time. They typically involve regular contributions from participants, which are then used to purchase gold. The accumulated gold can be held in a secure depository or, in some cases, used to purchase gold jewelry or other gold-based assets.

The Prince Jewellery Gold Scheme: A Closer Look

The Prince Jewellery Gold Scheme, as the name suggests, is often associated with a reputable jewelry retailer. It typically involves the following key elements:

- Regular Contributions: Participants commit to making regular payments, often on a monthly basis. The amount of each contribution can vary depending on the scheme’s design and the individual’s financial capacity.

- Gold Accumulation: Each contribution is used to purchase a specific amount of gold, which is held in a secure vault or depository. This ensures that the investment is backed by a tangible asset.

- Potential for Appreciation: The value of gold can fluctuate over time. If the price of gold rises, the value of the accumulated gold holdings will also increase, potentially generating returns for participants.

- Flexibility: Some schemes may offer options for withdrawing the accumulated gold or converting it into jewelry or other gold-based assets.

Benefits of the Prince Jewellery Gold Scheme

While every investment carries inherent risks, the Prince Jewellery Gold Scheme presents several potential advantages:

- Accessibility: It provides a structured and accessible method for individuals with limited financial resources to invest in gold. Regular contributions allow participants to build their gold holdings gradually.

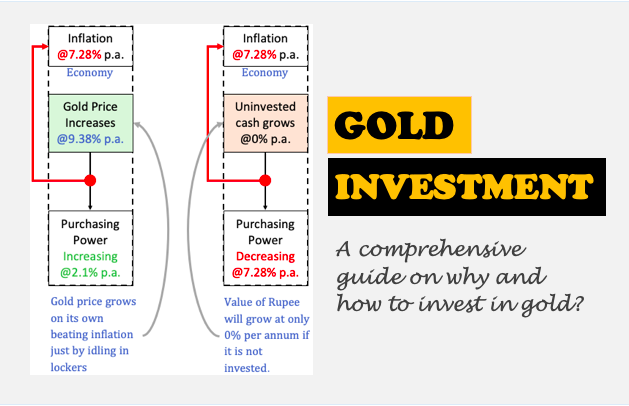

- Diversification: Gold is often considered a safe haven asset, meaning it can potentially preserve wealth during times of economic uncertainty. Including gold in a diversified investment portfolio can help mitigate overall risk.

- Tangible Asset: Gold is a tangible asset with intrinsic value. Unlike intangible assets, such as stocks or bonds, gold can be physically held and traded, providing a sense of security to some investors.

- Potential for Appreciation: As mentioned earlier, the value of gold can fluctuate, potentially leading to capital appreciation for investors.

Considerations and Risks

While the Prince Jewellery Gold Scheme offers potential benefits, it is essential to acknowledge the associated risks and considerations:

- Gold Price Volatility: The price of gold can be volatile, meaning it can fluctuate significantly in both directions. This volatility can impact the returns on an investment in gold.

- Interest Rates: Rising interest rates can make gold less attractive compared to other investments, such as bonds, which offer fixed interest payments.

- Liquidity: Gold can be illiquid, meaning it may not be easy to sell quickly at a desired price. This can be a concern if an investor needs to access their funds urgently.

- Storage Costs: Storing gold can involve costs, such as insurance and security fees, which can reduce overall returns.

- Scheme Specific Risks: It is crucial to carefully review the specific terms and conditions of any gold scheme, including fees, charges, and withdrawal options.

FAQs about the Prince Jewellery Gold Scheme

Q: What are the eligibility criteria for participating in the Prince Jewellery Gold Scheme?

A: Eligibility criteria can vary depending on the specific scheme. Typically, participants must meet age and income requirements and may be required to provide identification documents and proof of address.

Q: How much do I need to invest in the Prince Jewellery Gold Scheme?

A: The minimum investment amount can vary, but most schemes have a minimum contribution requirement. It’s crucial to review the scheme’s terms and conditions for details.

Q: How long do I need to invest in the Prince Jewellery Gold Scheme?

A: The investment period can vary depending on the scheme’s structure. Some schemes may have a fixed tenure, while others may offer flexibility in terms of investment duration.

Q: What are the fees associated with the Prince Jewellery Gold Scheme?

A: Fees may include administration fees, storage fees, and potentially other charges. It is essential to understand all fees and charges before committing to the scheme.

Q: How do I access my accumulated gold?

A: The method for accessing accumulated gold can vary depending on the scheme. Some schemes may allow for withdrawals in the form of gold, while others may offer the option to convert it into jewelry or other gold-based assets.

Tips for Evaluating the Prince Jewellery Gold Scheme

- Reputable Provider: Choose a scheme offered by a reputable and established jewelry retailer with a proven track record.

- Transparency: Ensure that the scheme’s terms and conditions are transparent and readily available for review.

- Fees and Charges: Carefully review all fees and charges associated with the scheme, including administration fees, storage fees, and potential penalties for early withdrawal.

- Investment Goals: Consider your investment goals and risk tolerance before committing to any gold scheme.

- Diversification: Remember that gold should be considered as part of a diversified investment portfolio.

- Professional Advice: Consult with a financial advisor to assess the suitability of the Prince Jewellery Gold Scheme for your specific financial situation.

Conclusion

The Prince Jewellery Gold Scheme presents a potential avenue for individuals to invest in gold through a structured and accessible approach. While it offers potential benefits such as accessibility, diversification, and the tangible nature of gold, it is essential to acknowledge the associated risks, including gold price volatility, liquidity concerns, and storage costs. Before committing to any gold scheme, it is crucial to thoroughly research the provider, understand the terms and conditions, and carefully consider your investment goals and risk tolerance. As with any investment, conducting due diligence and seeking professional advice can help ensure that your investment decisions align with your financial objectives.

Closure

Thus, we hope this article has provided valuable insights into Unraveling the Intricacies of Gold Investment Schemes: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!